How to Win a Chargeback as a Merchant: Key Tactics

Chargebacks can cause significant damage to a business, not only through lost revenue but also by straining merchant relationships with banks and payment processors. In 2023 alone, merchants lost an average of $3.75 for every $1 in fraud-related chargebacks due to additional fees, overhead, and penalties. Moreover, the rise in friendly fraud—a practice where legitimate customers dispute transactions—accounts for up to 80% of fraud-related chargebacks.

When a chargeback is filed, time is of the essence. To prevent further loss, merchants must act quickly and decisively. At Title, we’ve refined our approach to chargeback disputes, achieving an impressive 97% win rate. In this article, we will share the key tactics that have helped us achieve this success, as well as proactive strategies merchants can implement to prevent chargebacks before they occur.

Chargeback vs. Refund: What’s the difference?

Before diving into the chargeback process, it’s important to understand the difference between a chargeback and a refund. Though both involve returning money to the customer, the processes are quite distinct.

A refund occurs when a customer contacts the merchant directly to resolve an issue with a purchase. If the merchant agrees that the refund is justified—perhaps due to defective goods, a canceled service, or an honest mistake—the merchant processes the refund voluntarily. This is usually a straightforward process that helps maintain a positive relationship between the merchant and the customer.

A chargeback, on the other hand, is initiated by the customer through their bank or card issuer, rather than the merchant. This typically happens when the customer feels their issue has not been resolved by the merchant or they believe the transaction was fraudulent. Once a chargeback is filed, the bank takes control of the process, and the merchant must defend the transaction to recover the funds.

In other words, while refunds are a voluntary action initiated by the merchant, chargebacks are a dispute resolution mechanism that can lead to additional fees, penalties, and lost revenue if not handled effectively.

The chargeback process: A step-by-step overview

Now that we’ve clarified the difference between a refund and a chargeback, let’s take a closer look at the chargeback process itself. How does it unfold, and what steps are involved? Understanding these stages will prepare you for what to expect and how to respond when a chargeback is filed.

.webp)

Common reasons merchants face chargebacks

Chargebacks can happen for a variety of reasons, but some are more common than others. Understanding these typical causes can help merchants take proactive measures to prevent disputes before they arise.

Unauthorized charges

One of the most frequent causes of chargebacks is unauthorized charges. These disputes often occur due to forgotten purchases, fraudulent activity, or compromised card details. For example, subscription services can be a common source of confusion. A customer might not remember signing up for a subscription or may believe they canceled it, leading them to dispute the charge.

As Iryna Kardashova, Delivery Manager with 7 years of support experience working on Title's project, explains, “Customers may think that they canceled their subscription, but in fact, they didn’t, and they continue to be charged. This can happen if the cancellation process isn't clear or if there’s a technical error.”

Merchandise or service not received

Another common cause of chargebacks is when customers do not receive the products or services they paid for. This can result from shipping delays, lost packages, or issues with digital downloads. For instance, a customer might order a physical product but never receive it, or they could purchase a digital item and be unable to access it.

Iryna Kardashova emphasizes, “If customers don't receive the products or services they purchased, they may initiate a chargeback, regardless of whether the issue was caused by shipping delays or technical difficulties.”

Clear communication and timely delivery are essential in reducing these disputes.

Recurring billing problems

Recurring billing issues are another frequent source of chargebacks. These occur when customers are billed for a subscription they believe they canceled, or when the cancellation process is unclear.

Iryna highlights the importance of transparency, stating, “A clear cancellation policy is a must. If customers aren’t fully aware of how to cancel their subscriptions, or if they don’t receive confirmation, chargebacks are almost inevitable.”

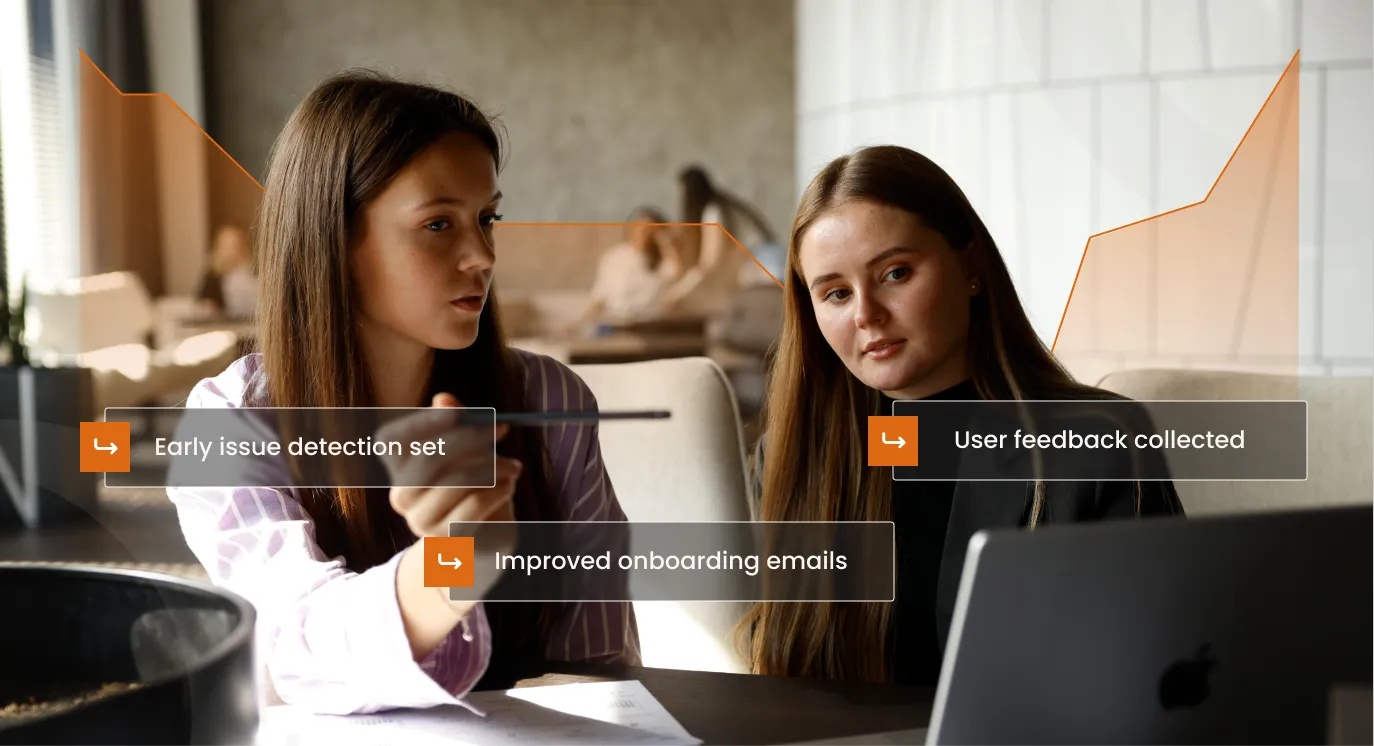

Proactive measures to prevent chargebacks

While it's impossible to completely eliminate the risk of chargebacks, there are several proactive measures merchants can take to reduce the likelihood of disputes. Our team at EverHelp has implemented these strategies in practice, and we’ve found them to be highly effective in preventing chargebacks before they happen.

Clear communication and transparent billing

As we’ve already mentioned, providing clear communication is key to preventing chargebacks. This includes offering detailed information about subscription services, using easily recognizable billing descriptors, and notifying customers well in advance of renewal periods. By ensuring customers are fully aware of what to expect, merchants can reduce misunderstandings that often lead to disputes.

Strong customer support

Customer support plays a crucial role in minimizing chargebacks. Offering immediate and empathetic support can help resolve issues before they escalate. When customers feel heard and their concerns are addressed promptly, they are far less likely to resort to a chargeback.

Verification processes

Another preventive measure that can be implemented is adding extra layers of verification during the transaction process. Using tools like CVV, 3DS, or phone verification helps ensure that the person making the purchase is authorized to do so. These steps add a layer of security that can deter fraudulent activity and protect the merchant from disputes.

How to respond when a chargeback is filed

So, let’s say you couldn’t prevent the chargeback from happening—what’s next? Once a chargeback is filed, time is of the essence. The following steps can help you navigate the chargeback process efficiently and maximize your chances of a successful outcome.

Review the reason code

The first step is to review the reason code provided with the chargeback. Each code indicates the customer’s reason for disputing the transaction. By understanding the specific reason behind the chargeback, you can tailor your response to address the issue directly. It’s important to approach each chargeback individually based on the given reason code.

Submit before the deadline

Time is critical when dealing with chargebacks. The sooner you respond, the better. Make sure to submit all necessary documentation before the deadline—ideally a few days in advance. This demonstrates that you’re acting in good faith and gives you room to address any potential issues that could arise.

Gather evidence

Maintaining detailed records is key to building a strong defense. Collect all relevant documentation, such as invoices, proof of delivery, communication with the customer, and any other supporting evidence. This will provide a clear record of the transaction and help validate your claim that the chargeback is unwarranted.

Write a clear rebuttal

Your rebuttal letter is your chance to explain your side of the story. Be sure to clearly articulate your position, backed by the evidence you’ve gathered. A well-written, concise rebuttal can go a long way in convincing the bank to side with you in the dispute.

Submit your response

Once you’ve gathered your evidence and written your rebuttal, it’s crucial to submit your response promptly. Ensure that your documentation is complete, well-organized, and submitted within the required timeframe. This increases the likelihood of a favorable outcome.

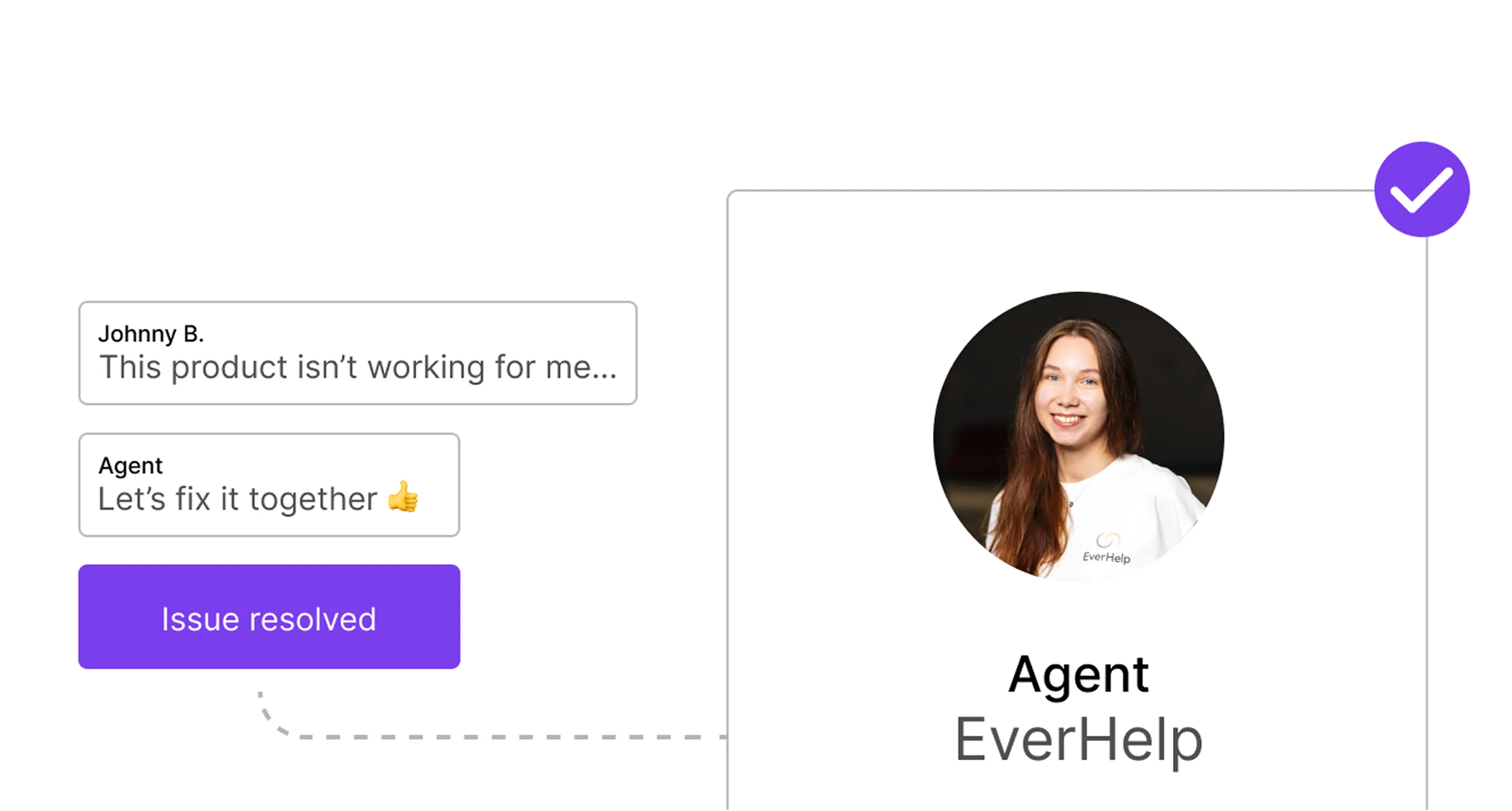

How to prevent chargebacks through customer service?

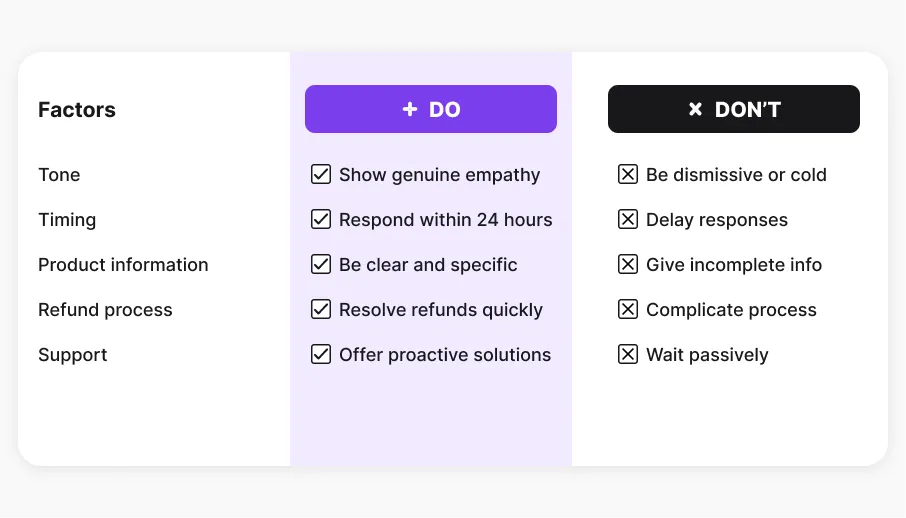

At EverHelp, we know that great customer service is one of the strongest defenses against chargebacks. By focusing on empathetic support, clear communication, and prompt resolution of issues, businesses can prevent many disputes before they even begin. Drawing on our experience, we’ve compiled the following best practices to help you improve customer service and reduce chargebacks. To summarize these practices, we’ve also provided a quick dos and don'ts table at the end of this section.

Empathetic and immediate responses

Offering immediate and empathetic support is one of the most effective ways to prevent chargebacks. When customers feel that their concerns are heard and addressed in a timely manner, they are far less likely to initiate a chargeback. Quick responses to inquiries, combined with a willingness to help, can prevent frustrations from turning into disputes.

Clear product and policy information

Providing customers with detailed and transparent information about your products, services, and policies is another key strategy. If customers clearly understand what they are purchasing and are aware of your policies—such as returns, cancellations, and warranties—they are less likely to feel misled or confused. This clarity helps to minimize disputes related to misunderstandings.

Efficient refund processes

A hassle-free and prompt refund process can also play a significant role in preventing chargebacks. When customers are dissatisfied with a product or service, offering a quick and easy refund can often resolve the issue before it escalates. By handling refunds efficiently, you not only reduce the risk of chargebacks but also improve customer satisfaction and loyalty.

And as promised, here’s a quick summary of the key dos and don'ts when it comes to preventing chargebacks through customer service:

How outsourcing customer support can help manage chargebacks

Outsourcing customer support provides a powerful way for businesses to manage the complexities of chargeback disputes. By partnering with specialized teams, businesses gain access to professionals who focus exclusively on chargeback management. These experts handle disputes from start to finish, drawing on their deep knowledge of the processes to build strong cases and increase success rates. This dedicated focus frees up your internal team to concentrate on core operations, while the outsourced team ensures that chargebacks are managed efficiently and effectively. Their expertise helps streamline the entire dispute process, making sure that no detail is overlooked.

In addition to expertise, outsourcing teams bring advanced technology into the mix. Tools like real-time alerts, fraud screening, and case management systems enable faster responses, better tracking, and more comprehensive analysis. These technologies provide crucial insights into chargeback trends, helping to identify potential risks and allowing for proactive prevention of future disputes. By integrating cutting-edge technology with specialized expertise, outsourcing helps businesses manage chargebacks more effectively, reducing both the frequency of disputes and the financial impact on the company.

Take charge of chargebacks with expert support

Dealing with chargebacks can feel overwhelming, but it doesn’t have to be. By staying proactive—understanding the chargeback process, reviewing reason codes, and submitting strong, evidence-backed responses—you can turn the odds in your favor. And by focusing on clear communication, empathetic customer support, and quick refunds, you can even reduce the chances of chargebacks happening in the first place.

At EverHelp, we get it. We know the stress chargebacks can cause, and we’re here to take that burden off your shoulders. With our specialized teams and advanced technology, we’re ready to help you manage chargebacks efficiently and effectively, so you can focus on what matters most—growing your business. Book a meeting today!

.webp)

.webp)

_%20Strategies%2C%20Tools%20%26%20A%20Client%20Success%20Story%20(3).png)

.webp)

.webp)